|

|

Post by ComfortZone on Apr 2, 2024 9:27:27 GMT 12

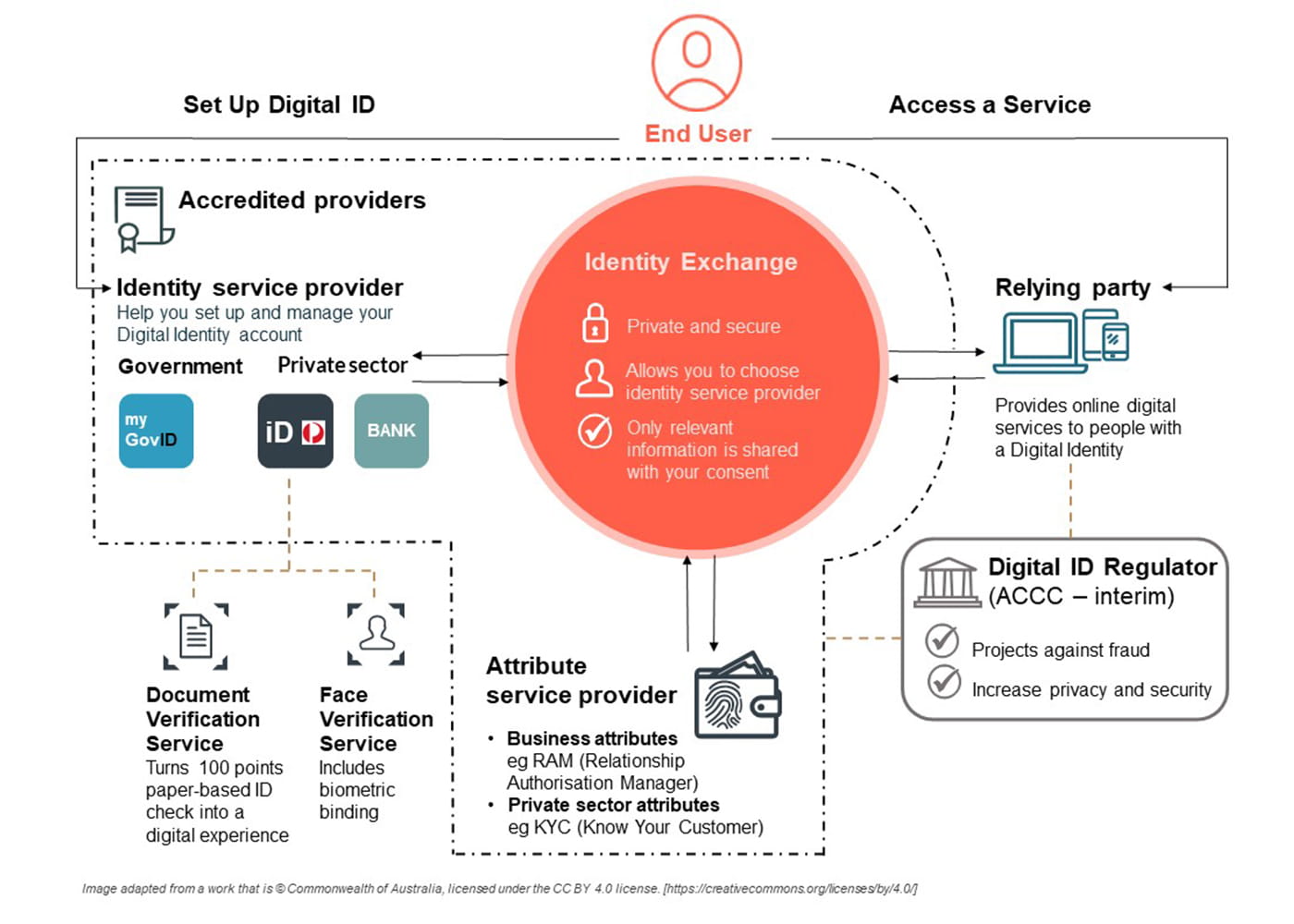

There is a "protest" day running today in Australia highlighting the concerted attack on peoples' continued access to draw and spend cash www.youtube.com/watch?v=bpf0oZo5jTs&t=7sBanks there are closing ATMs in huge numbers, when I was in Perth November late last year it was a mission to find an ATM outside the city centre and those that still existed were often inside shopping centres which could not be accessed after hours. Of course the Government, RBA and banks are denying there is a drive to the cashless society but as usual actions speak louder than words. Associated with this, the Liebour government in Australia has just bulldozed a Digital Identity bill thru the Sentate www.ashurst.com/en/insights/a-deeper-dive-into-australias-digital-id-bill/dailydeclaration.org.au/2024/03/28/digital-id-bill/All very convenient for establishment of a CDBC and Social Credit scoring. The Ashurst piece includes this diagram, the very same diagram (with some names changed) I posted a couple of years ago in relation to the NZ Digital bill  Of course security and privacy is guaranteed, except when sites are hacked (including my Medibank Private details per their notification of a hack) or Chinese government wants to collect data, or people let info leak, think the gun register here. All a great concern! |

|

|

|

Post by harrytom on Apr 2, 2024 12:59:31 GMT 12

ATMs started dissapearing here a 1yr or 2ago. Go to Thames no ATM was a ASB outside Goldfields.nearest one now is a ANZ in Paeroa. ANZ pulled out of Z karaka.Waihi I think there is a westpac or ANZ but not where you would notice it.

|

|

|

|

Post by GO30 on Apr 2, 2024 15:24:02 GMT 12

Part of the move to cashless is to also maximise tax intake. The black economy in NZ and undoubtedly Aussie is huge.

I still use cash a lot and when faced with a shop that says 'Sorry, we don't do cash any longer I respond 'No worries, I don't do you any longer either', everyone has a competitor. Actually swapped our electrical bits and bods supplier 3 weeks ago due to that very reason. The lady on the front desk said she'd happily pass on to management why they lost us. You do have to make sure they know why your leaving.

|

|

|

|

Post by ComfortZone on Apr 2, 2024 16:53:12 GMT 12

Part of the move to cashless is to also maximise tax intake. The black economy in NZ and undoubtedly Aussie is huge. I still use cash a lot and when faced with a shop that says 'Sorry, we don't do cash any longer I respond 'No worries, I don't do you any longer either', everyone has a competitor. Actually swapped our electrical bits and bods supplier 3 weeks ago due to that very reason. The lady on the front desk said she'd happily pass on to management why they lost us. You do have to make sure they know why your leaving. There is also the creeping scourge of credit card surcharges, on the one hand businesses don't want your cash but on the other they want to charge you for using a card. The worst gouging I have experienced was the Warkworth A and P show, they were charging a 5% surcharge. Absolute theft seeing as the typical charge to a business for cards is 0.9 - 1.5% (per a mate who is doing work for Paymark). Savan's bakery in Warkworth (great pies) is charging 3%, I told them they were a bunch of bandits and the staff just shrug their shoulders, so will always use cash. I was told both Burnsco and Swashies (to name 2) have backed down on credit card charges because there were so many complaints.Some establishments will not accept cash, Man O War vineyard is one I experienced recently. GF was visiitng Gold Coast a couple of months ago and had a stack of stuff she intended to buy in a clothing shop, they refused to take her cash so she left it on the counter and walked out. Should we finish up in a cashless society we will all be totally at the mercy of the government and the banks. I can see bartering expanding at a great rate and then a parallel "currency" developing. |

|

|

|

Post by harrytom on Apr 2, 2024 16:53:36 GMT 12

Part of the move to cashless is to also maximise tax intake. The black economy in NZ and undoubtedly Aussie is huge. I still use cash a lot and when faced with a shop that says 'Sorry, we don't do cash any longer I respond 'No worries, I don't do you any longer either', everyone has a competitor. Actually swapped our electrical bits and bods supplier 3 weeks ago due to that very reason. The lady on the front desk said she'd happily pass on to management why they lost us. You do have to make sure they know why your leaving. Becoming part of shopping lately. No cash accepted,well I guess no sale then ,sure as heck not using Eftpos for a $2 item |

|

|

|

Post by DuckMaster on Apr 2, 2024 19:47:41 GMT 12

Cash is a pita. There's no need for it today.

The removal of ATMs is a cost saving exercise. Like anything, once one provider starts doing something that makes them more profitable others will follow.

Cash has all the issues from employee stealing, store getting robbed, to incorrect change being given... When we owned a ice cream parlour years and years ago, with 1000s of small transactions going through it was rare that the til balanced. It was usually always out somewhere between 5c and a few dollars... And an employee was paid an hourly rate to count it twice... COMPLETE WOFTAM.

How many employers pay there staff in cash? How many even have it as an option? I bet today it's exactly zero.

Cashless is the way of the future. Cash benefits no business at all.

|

|

|

|

Post by harrytom on Apr 2, 2024 22:04:20 GMT 12

Cash is a pita. There's no need for it today. The removal of ATMs is a cost saving exercise. Like anything, once one provider starts doing something that makes them more profitable others will follow. Cash has all the issues from employee stealing, store getting robbed, to incorrect change being given... When we owned a ice cream parlour years and years ago, with 1000s of small transactions going through it was rare that the til balanced. It was usually always out somewhere between 5c and a few dollars... And an employee was paid an hourly rate to count it twice... COMPLETE WOFTAM. How many employers pay there staff in cash? How many even have it as an option? I bet today it's exactly zero. Cashless is the way of the future. Cash benefits no business at all. You need cash,look at Cyclone Gabrielle,CHCh earthquakes,no cash no petrol or food as banks offline or Atm/eftpos didnt work.We have about $500 in cash at home and usually $50 in wallet just incase. |

|

|

|

Post by em on Apr 3, 2024 6:38:34 GMT 12

Anyone know what the banks etc do for security regarding server farms where all the data (money) is stored ? Any major cyber or physical attack would render us penniless in an instant. Old mate Phil Arpers could’ve stuffed up our shopping for awhile but I guess the server farms have backup gens for that scenario .

|

|

|

|

Post by fish on Apr 3, 2024 7:45:29 GMT 12

Cash is a pita. There's no need for it today. The removal of ATMs is a cost saving exercise. Like anything, once one provider starts doing something that makes them more profitable others will follow. Cash has all the issues from employee stealing, store getting robbed, to incorrect change being given... When we owned a ice cream parlour years and years ago, with 1000s of small transactions going through it was rare that the til balanced. It was usually always out somewhere between 5c and a few dollars... And an employee was paid an hourly rate to count it twice... COMPLETE WOFTAM. How many employers pay there staff in cash? How many even have it as an option? I bet today it's exactly zero. Cashless is the way of the future. Cash benefits no business at all. You need cash,look at Cyclone Gabrielle,CHCh earthquakes,no cash no petrol or food as banks offline or Atm/eftpos didnt work.We have about $500 in cash at home and usually $50 in wallet just incase. This. Having been dropped into Chch by the Airforce the morning after the quake, this is a far bigger issue than you could understand. The classic example was needing to boil water. I saw a que at a gas station of people trying to fill their LPG BBQ bottles. Generator providing power (as gas is deemed an essential service), but with no phone / internet comms, very few people could actually pay for their LPG. No LPG, no boiled water, and no food cooking. Not to mention no buying food. Bearing in mind the situation was like that for almost all of Eastern Chch for about 14 days, in places longer, yeah, it is very important to keep several hundred in folding cash at home, and a good amount in your wallet. Even if you wanted to just hop in your car and get out of dodge, you'd need petrol... which you need to pay for somehow... |

|

|

|

Post by ComfortZone on Apr 3, 2024 8:14:41 GMT 12

Duckie talks about cash being a PITA for business. That may well be true, but it is up to business to respond to their customers' preferences not the other way around. We are already seeing this with the pushback against card fees and refusing to take cash. Yes I well remember the days of being paid in cash and similarly paying my troops in cash on jobs. The change to bank deposits was not the choice of the workers, it was driven by the banks to increase their business. Cash is the best tool for those on a budget. Counsellors assisting people in financial strife always recommend the first step to getting their situation under control is to cut up all their cards and work on a cash basis. When you look in your wallet and know that the cash there has to keep you going for the rest of the week, you immediately think about is this expenditure really necessary. In addition to events such as the CHCH earthquake, recently Optus had their servers crash in Australia in November last year, brought the country to a halt and the only way to make purchases in many outlets was with cash. Remember the issue with gas stations on 29th Feb Overseas there is a growing push against the move to CDBC's , eg thehill.com/business/4490324-gop-senators-propose-ban-on-central-bank-digital-currencies/Republican senators introduced legislation Monday that would ban official cryptocurrencies backed by central banks, a type of proposed digital asset that the Biden administration and Federal Reserve have expressed interest in studying.GOP senators said that Fed-backed cryptocurrencies would pose privacy concerns and allow regulatory authorities access to the private spending habits of individual Americans.Sen. Ted Cruz (R-Texas) described Fed-backed digital currencies, which are also known as Central Bank Digital Currencies (CBDC) or stablecoins, as “programmable money that, if not designed to emulate cash, could give the federal government … significant transaction-level data down to the individual user.”Something to watch |

|

|

|

Post by GO30 on Apr 3, 2024 10:47:42 GMT 12

Cash is a pita. There's no need for it today. The removal of ATMs is a cost saving exercise. Like anything, once one provider starts doing something that makes them more profitable others will follow. Cash has all the issues from employee stealing, store getting robbed, to incorrect change being given... When we owned a ice cream parlour years and years ago, with 1000s of small transactions going through it was rare that the til balanced. It was usually always out somewhere between 5c and a few dollars... And an employee was paid an hourly rate to count it twice... COMPLETE WOFTAM. How many employers pay there staff in cash? How many even have it as an option? I bet today it's exactly zero. Cashless is the way of the future. Cash benefits no business at all. You haven't been in business lately then.

What does the line - 28 Mar 24 - EX548-65-789456B $1125.23 mean on our bank statement? A genuine question as it's there and a week later we still have no idea why or who. They are becoming quite common as we now get deposits in there from interweb banking, EFTPOS, Credit cards, Paypal, Stripe and our internet gateway people EWay via the BNZ. Of course each has it;s own system so the office has to spend lots of time tracking which is what and a lot is only identified by the sum. But as most of the above like to clip tickets the sum can be a very unreliable number to use to workout which is what. So often we have to wait until someone bitches then get them to tell us how, when and any unique numbers we can use to suss from our end. It's getting worse not better.

Where cash is so simple, black or white and a lot faster.

We have one who gets paid in cash. It's easy as and he gets it 10amevery wednesday morning without fail, the rest of us have to wait until the payment people run it thru their bank which instructs our bank to fire it to the assorted bank accounts.That system is so simple it can never fail...oppps, bar the multiple times it does.

Surcharges.We don't on the EFTPOS machine as it is that old it predates surcharges but the new machine due all by October, a system wide security update will make many machines redundant (anther $900-2000 per machine cost on business) will do surcharges. The EFTPOS people have it doing that as default now but we can turn it off. We can send invoices by email and on them there is a 'Pay now' button which takes you to Stripe and you can pay via that. They have a 'convenience fee' and 'convenience' is by a MASSIVE margin why most people shop where they do, which we note but also have interweb banking details for those whom conveniance is not a primary aim. About 50-50 between those who pay the fee and those who use interweb banking instead.

When I use EFTPOS I use pin numbers so the business doesn't have the cost, unless it is mobs like petrol companies, offshore owned mobs like bumblings and others who like to take the piss.

Card and payment fees add up to a LOT even for little fellas like us. Taking Visa alone costs us over $1000 a month and those cost do have to be passed on so you are paying for someone elses convenience.

It's not only Banks with insidious little fees that comes months end are a big number. Govt Depts love them, the freight industry has mastered them and the list grows. |

|

|

|

Post by harrytom on Apr 3, 2024 12:11:54 GMT 12

It's not only Banks with insidious little fees that comes months end are a big number. Govt Depts love them, the freight industry has mastered them and the list grows.

Yes IRD springs to mind,can pay through Wespac going in to branch and pay a fee or can do online and pay a $9 fee. Yes I paid the fee.Owned them $150 due to leaving one job,going temping the next day so when I got paid out and paid looks like I earnt a shit load.IRD said ,Oh you should of taken 2 week break .Bugger me.

|

|